- Bitcoin Minimalist

- Posts

- IMF on Bitcoin, Prime Trust, Bitgo Terminates Acquisition - Week 43

IMF on Bitcoin, Prime Trust, Bitgo Terminates Acquisition - Week 43

To catch the weekly synopsis, consider subscribing to The Bitcoin Minimalist!

News

CPI Reduced To 3%

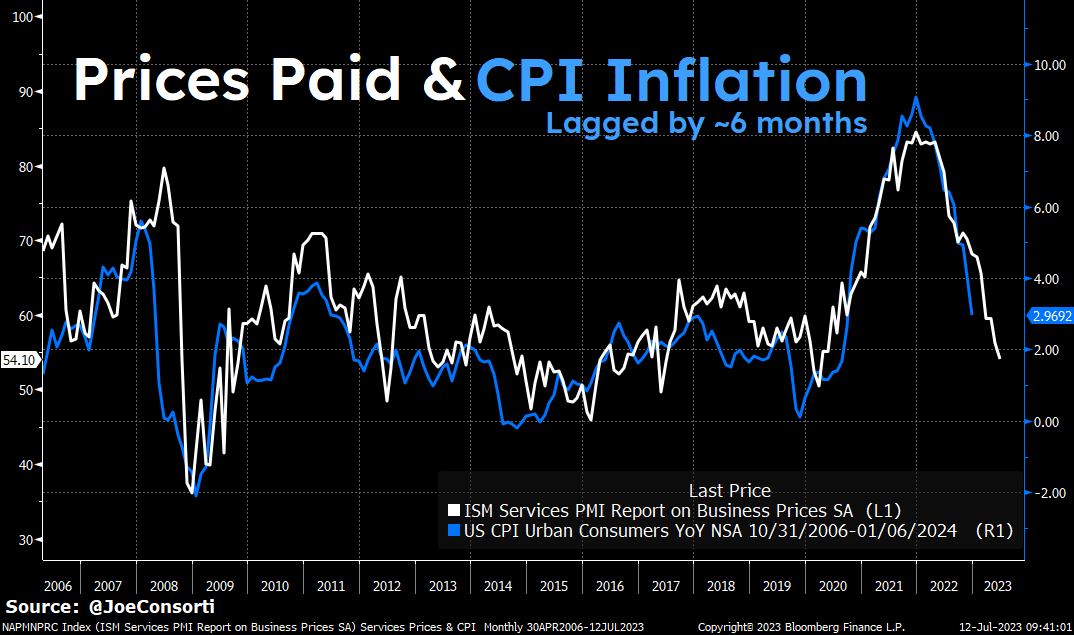

U.S. inflation continues to cool, with consumer prices increasing by 3% from a year earlier, the smallest yearly increase since March 2021.

On a monthly basis, prices rose 0.2%. The easing inflation was driven by flat grocery prices, offsetting higher gasoline costs and rent hikes.

The core inflation, which excludes food and energy, eased more than expected. While inflation has come down significantly from its 40-year high, achieving the desired 2% level policymakers seek may prove to be challenging.

IMF Says “Banning Bitcoin Not Effective”

The International Monetary Fund (IMF) has stated:

While a few countries have completely banned crypto assets given their risks, this approach may not be effective in the long run.

While acknowledging the potential risks, the IMF believes that a balanced regulatory framework that addresses concerns while allowing for innovation and meeting the market's demands would be more beneficial. This is a strong statement considering they have been attacking El Salvador since they legalized Bitcoin in June 2021.

Bitgo Terminates Acquisition of Prime Trust

BitGo, a leading cryptocurrency custodian, has terminated its planned acquisition of Prime Trust, a digital asset infrastructure provider.

The termination comes from the company failing to obtain the necessary regulatory approval for the acquisition.

BitGo initially announced the acquisition in March 2023, aiming to enhance its capabilities and expand its services. Despite the deal's termination, BitGo remains committed to serving its clients and delivering innovative solutions in the cryptocurrency industry. It is usually not a good sign when another company backs out of an acquisition deal, particularly in the middle of legal trouble.

Prime Trust loses $82 million Worth of Users Funds

Prime Trust, a digital asset custody provider, experienced a wallet disaster, losing $82 million worth of cryptocurrencies.

The incident occurred due to a private key deletion error, leading to the irreversible loss of the funds. Prime Trust is now working with law enforcement and forensic investigators to determine the cause of the incident and explore potential recovery options, although it may be an internal error.

The incident highlights the importance of strong security measures and careful management of private keys in the cryptocurrency industry.

SEC Fines JPMorgan

The U.S. Securities and Exchange Commission (SEC) has imposed a fine on JPMorgan after the accidental deletion of 47 million banking records.

The incident occurred during a routine technology update, leading to losing important customer information. JPMorgan has agreed to pay a fine of $4 million as part of a settlement with the SEC. The incident highlights the significance of maintaining robust data management systems and the potential risks associated with technology upgrades in the financial industry.

Price

In the short term (and even over the medium term), Bitcoin has gone sideways for months now. But zoom out, and it has continued to perform as one of the best assets YTD with an improvement of 86%. Bitcoin seems to be slowly pulling itself out of the bear market while everyone else has forgotten about it. This is how every cycle in the past has started.

Fidelity’s Bitcoin adoption model predicts a steady asset valuation climb. This model uses the adoption curve of the internet and real rates around 2%. It shows below an almost 91% correlation due to the network size. If you aren’t familiar with S-curve and technological adoption curves, look into Metcalfe’s law.

Tweets

Jobs

We have recently launched Bitcoinjobs.com! Looking for a job in the Bitcoin space? Visit Bitcoinjobs.com for more job openings.

What to read

July Newsletter - Lyn Alden

Thanks for reading The Bitcoin Minimalist! Subscribe for free to receive new posts and support my work.