- Bitcoin Minimalist

- Posts

- U.S. Court Backs Grayscale in Suit Against SEC

U.S. Court Backs Grayscale in Suit Against SEC

Plus: Chainalysis Software Credibility Questioned

Today we’re covering:

Securities and Exchange Commission loses major lawsuit,

U.S. Congressman Warren Davidson wants Gensler Fired,

Chainalyses’ Head of Investigations admits very little science used,

And everything else you need to know.

— Colin

First time reading? I’m Jordan, and this is the Bitcoin Minimalist. Every day, our team scours dozens of sources to bring you need-to-know Bitcoin news and insights—all in 5 minutes. Were you forwarded this email? Sign up here.

BITCOIN ETF

U.S. Court Backs Grayscale in Suit Against Gensler’s SEC

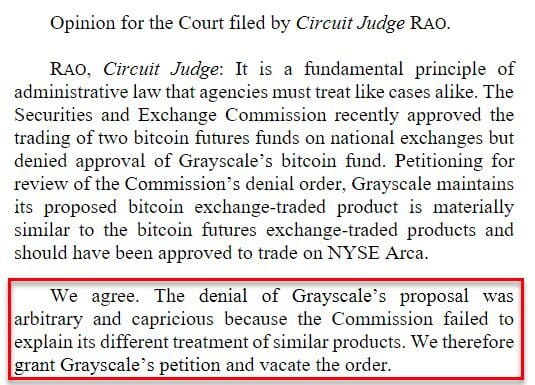

The Verdict: The US Court of Appeals DC Circuit supported Grayscale in its ongoing dispute with the US Securities and Exchange Commission (SEC) regarding its Bitcoin ETF conversion proposal.

Key Ruling Points: A unanimous 3-0 decision by the judges indicated that the SEC's refusal of Grayscale's ETF conversion was “arbitrary and capricious.” They further rules that the SEC failed to explain its differential treatment of comparable products, and its reasons against Grayscale's bid were insufficient.

Spot vs. Futures Market: The judges emphasized the high correlation between CME bitcoin futures prices and spot market prices. Grayscale's evidence, which was not disputed by the SEC, showed a 99.9% correlation. The SEC's arguments against Grayscale were considered lacking, particularly when comparing Grayscale's product with bitcoin futures ETPs.

Future Outlook: Just yesterday, Bloomberg Analysts Eric Balchunas and James Seyffart stated:

"The chances of the SEC approving spot Bitcoin ETFs this year have risen [to] 75% from 65%…while the odds by the end of 2024 reach 95%….The judges unanimously repudiated the SECs arguments, and the agency will struggle to justify further denials as it faces deadlines, negative PR and HashDex's novel approach."

WHAT WE'RE WATCHING

🇺🇸 US Congressman Warren Davidson calls to remove SEC Chair Gary Gensler following Grayscale's win against the SEC. In a tweet to his followers on Tuesday, Rep. Davidson blasted Gensler, saying “More evidence that Gary Gensler’s actions at the SEC are arbitrary and capricious”, followed with #FireGaryGenslerM

📜 X (formerly Twitter) has finally received money transmitter licenses for several states. So far, the list of states granting such a license include Georgia, Arizona, Rhode Island, Maryland, Michigan, Missouri, and New Hampshire. These licenses will allow X to store, transfer, and exchange Bitcoin and other digital assets on behalf of its users.

🔻 Bitcoin Balances on Coinbase are at an all time low since their peak in March of 2020. Current balances sit at 439,000 Bitcoin on deposit. This is down from a high of over 1,000,000 BTC during March of 2020. Balances have steadily fallen since then, with other exchanges seeing similar drops.

🌎 Binance introduces "Send Cash," facilitating crypto-to-cash transfers in nine Latin American countries, focusing initially on Colombia and Argentina. Users will be able to use crypto on their Binance accounts to send cash directly to the bank accounts of those they are sending to. This move showcases Binance's aggressive growth strategy into LATAM countries, especially in the areas of remittances; a huge pain point for citizens of those countries.

Chain Analyses

Chainalysis Software Credibility Questioned, Key Official Admits Lack of Scientific Rigor

The Scoop: Elizabeth Bisbee, the head of investigations at Chainalysis Government Solutions, admitted during a court hearing that she was unaware of scientific proof regarding the accuracy of the company's flagship chain analyses software, Reactor, a tool used by law enforcement to trace coins on various blockchains.

Legal Spotlight: The Reactor software's reliability came under scrutiny due to a legal case involving the U.S. government and Roman Sterlingov, the alleged founder of the Bitcoin Fog cryptocurrency mixer. Lawyer Tor Ekeland, defending Sterlingov, challenged the software's credibility, referring to it as a "black box algorithm" built on "junk science."

Seeking Proof: When questioned about the Reactor's accuracy and its scientific validation, Bisbee could not provide statistical error rates and was unaware of any peer-reviewed evidence affirming its accuracy. Chainalysis asserts that, while not academically "peer-reviewed," their software's conclusions can be independently verified. However, they admitted to having no data on margins of error and false positive/negative rates for their software.

Peers Agree: Coinbase also offers its own law-enforcement grade chain analyses software suite called Tracer. In a March 28, 2022 blog post, they too admitted that “blockchain analytics is more of an art than a science”; a concerning admission from the industry’s top providers when such software is used to investigate and ultimately convict individuals of serious crimes.

POLL

Does you believe Grayscale's win against the SEC makes a spot ETF approval a sure thing? |

Tuesday’s Poll Results

Are you concerned about BlackRock's involvement in 4 of the top 5 largest US mining companies?

Yes - 45%

No - 55%

👍 Yes: “BlackRock is first and foremost a highly compliant financial institution. If Uncle Sam says jump, they will ask "‘How high?’” - Sean

👍 No: “BlackRock’s ownership is actually a good thing - they clearly have tons of sway over congress so I think we can expect favorable policy going forward.” - Anonymous

IN THE LOOP

🤝 UAE Economic Minister claims that, while the country will inject more capital into BRICS bank, it will also seek to deepen ties with USA. The news breaks from more recent outspoken membership acceptances that were outright hostile to Uncle Sam and dollar dominance.

💼 Digital Currency Group (DCG) has reached an agreement with Genesis' Lending to recoup money owed in wake of Genesis bankruptcy. The deal potentially allows DCG customers who had funds on deposit with DCG and staked with Genesis to recover 65%-90% of their lost funds. Genesis halted withdrawals last year and filed for bankruptcy protection in 2023 following the collapse of FTX.

📈 Just ahead of the DC Appeals court Grayscale decision, nearly 30,000 BTC were moved to centralized exchanges, suggesting that some traders may have foreseen the ruling and prepared to capitalize on the anticipated price surge.

Today’s newsletter was written by Jordan and edited by Colin.