- Bitcoin Minimalist

- Posts

- BlackRock ETF/Trust, Unregistered securities, & CBDCs - Week 42

BlackRock ETF/Trust, Unregistered securities, & CBDCs - Week 42

To catch the weekly synopsis, consider subscribing to The Bitcoin Minimalist!

News

SEC Targeting Exchanges Continue

The U.S. Securities and Exchange Commission (SEC) has intensified its focus on crypto exchanges, with notable targets including Binance, Coinbase, and others. The SEC has taken legal action against these prominent cryptocurrency exchanges, alleging that they have violated securities laws by operating as unregistered exchanges. These actions demonstrate the SEC's determination to enforce regulatory compliance and safeguard investor interests within the cryptocurrency industry.

Cyber Attack on SWIFT

According to Techzine, the European Investment Bank (EIB) was targeted by a group of hackers known as "Killnet" in a recent cyberattack. Killnet has a track record of targeting financial institutions, and this attack resulted in the compromise of sensitive data at the EIB. The motives behind the attack remain unclear.

In addition to the EIB incident, last week also saw the Society for Worldwide Interbank Financial Telecommunication (SWIFT) experiencing downtime, further highlighting the vulnerability of financial systems to cyber threats.

JUST IN - U.S. federal government agencies hit in global cyberattack, CISA "working urgently to understand impacts" — CNN

A day later, 20 new countries applied to join the BRICS alliance. The BRICS alliance is a group of major emerging economies that has established the New Development Bank (NDB) as a financial institution to fund infrastructure and sustainable development projects in member countries and other developing nations.

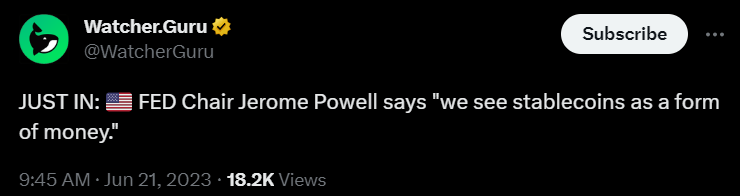

CBDC Updates

The IMF is reportedly exploring the development of a digital currency that can be utilized by central banks worldwide. The platform aims to address various financial challenges, including improving financial inclusion and enhancing cross-border payments.

Black Rock Files for ETF

BlackRock, the world's largest asset manager, has applied with the U.S. Securities and Exchange Commission (SEC) for a Bitcoin exchange-traded fund (ETF).

The decision to file for a Bitcoin ETF reflects the growing institutional interest in cryptocurrencies and their increasing acceptance as an investment asset class.

The SEC will review the application and assess its compliance with regulatory requirements before deciding whether to approve or reject the proposed ETF. BlackRock's Bitcoin ETF filing has led to a surge in new filings within the cryptocurrency industry, bringing renewed optimism but also concern as to why there were so many rejections for ETFs before.

Wall Street Jumps Head First Into Bitcoin

Deutsche Bank has applied for a cryptocurrency custody license, indicating its foray into the digital asset realm and reflecting traditional financial institutions' increasing acceptance of cryptocurrencies.

According to The Wall Street Journal, a cryptocurrency exchange backed by Citadel Securities, Fidelity, and Charles Schwab has also launched its operations. The exchange, called EDX, aims to provide a platform for institutional investors to trade cryptocurrencies efficiently.

On top of that, Mastercard strengthens its presence in cryptocurrency by filing a new trademark application, indicating the company's ongoing interest and potential plans for further involvement in the digital asset industry.

Price

After the ETF announcement by Blackrock, the Bitcoin price pumped up around 15% on the week. Blackrock ETF applications have a historical 95% approval rate.

Since the SEC crackdown on exchanges, Bitcoin dominance has been rising and has climbed up to 56% now. The dominance takes the total “crypto” market cap and uses Bitcoins market cap percentage.

Tweets

International Remittance Fees

One of the Largest Bank in Spain Tweets about Lightning

Jobs

We have recently launched Bitcoinjobs.com! Looking for a job in the Bitcoin space? Visit Bitcoinjobs.com for more job openings.

What to read

FULL REPORT: Binance Revisited - Warning Signs At The World's Largest Bitcoin Exchange - Dylan Leclair

Blackrock Creates Poor Imitation Onramp Bitcoin Trust- Jesse Meyers